Cash Advance Request, Granting and Utilization as a Special Disbursing Officer

Definition of Terms

Special Disbursing Officer (SDO)

An SDO is a duly appointed disbursing officer assigned for a specific time-bound, legal undertaking. For research projects/programs

S/he is usually the Project Leader/Program Leader/Principal Investigator. S/he has the authority to request for, disburse and liquidate special cash advances for current operating expenses.

As an SDO, the Researcher is deemed an Accountable and Bondable Officer.

Accountable Officer

Refers to every officer of the government whose duties permit or require the possession or custody of government funds and property and who shall be accountable thereof and for the safekeeping thereof in conformity with laws and regulations.

Bondable officer

Every officer, agent and employee of the Government of the Philippines or of the companies or corporations of which the majority of the stock is held by the National Government, regardless of the status of their appointment shall, whenever the nature of the duties performed by such officer, agent, or employee permits or requires the possession, custody or control of funds or properties for which he is accountable, be deemed a bondable officer and shall be bonded or bondable and his fidelity insured.

Cash Advance

Based on COA Circular No. 97-002 date February 10, 1997, the following are the guidelines for the grant and liquidation of cash advances:

- No cash advance shall be given unless for legally authorized specific purpose.

- No additional cash advance shall be allowed to any official or employee unless the previous cash advance given to him is first liquidated and accounted for in the books.

- A cash advance shall be liquidated/reported on as soon as the purpose for which it was granted has been served.

- Except for cash advances for travel, no officer or employee shall be granted cash advance unless he is properly bonded in accordance with law or regulations. The amount of cash advance which may be granted shall not exceed the maximum cash accountability covered by his bond.

- Only permanently appointed and duly designated disbursing officers shall be granted cash advance. However, these requirements shall not apply for cash advances for travel.

- Transfer of cash advance from one accountable officer to another shall not be allowed.

- The cash advance shall be used solely for the specific purpose for which it was granted. Under no circumstances shall it be used for encashment of checks or for liquidation of a previous cash advance.

- No cash advance shall be granted for payments on account of infrastructure projects or other undertaking on a project basis.

- Cash advance for special time-bound undertaking shall be liquidated by the accountable officer concerned within one month from the date of the purpose of the cash advance was accomplished.

- Cash advances which are no longer needed or have not been used for a period of two months shall be returned to or deposited immediately with the proper collecting officer or treasurer.

- All cash advances shall be fully liquidated at the end of the year. Except for petty cash fund, the accountable officer shall refund any unexpended balance to the cashier/collecting officer who shall issue the necessary official receipt.

According to COA Circular 97-002 4.4 Field/Activity Current Operating Expenses and COA Circular 2012-001 1.1.3 Field/Activity Current Operating Expenses:

- The special cash advance shall be used to pay the salaries and wages of the employees and the miscellaneous operating expenses of the activity. Payment for each transaction shall not be subject to amount limitation. However, all payments shall be approved by the Director/Head of Field Office.

- The amount of cash advance shall be limited to the requirements for two months. Within 5 days after the end of each month, the AO shall submit a Report of Disbursements. Additional cash advances shall be granted on the basis of the activity budget or the requirements for two months, whichever is lower.

- The cash advance shall be supported by the following documents:

- Copy of authority by the Agency Head (Administrative Order as a Special Disbursing Officer)

- Copy of approved application for bond (Form 57A and 58A)

Budget for Current Operating Expenses of the Agency field office or agency activity in the field (Line Item Budget and Cash Program)

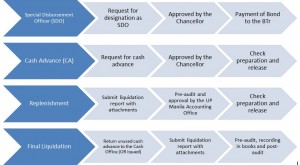

How to Apply for an SDO Designation

How to Increase Cash Accountability

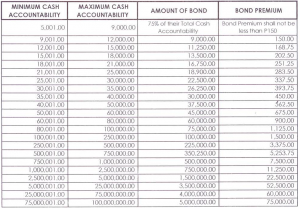

Revised Schedule of Premium Rates

Reference:

Treasury Circular No. 02-2009 dated August 6, 2009. Revised Omnibus Regulations Governing the Fidelity Bonding of Accountable Public Officers Pursuant to the Public Bonding Law (Sections 313 – 335 Chapter 15, Revised Administrative Code of 1917)

First step: Apply for an SDO Designation